September 2024 (Burlington, VT) - The Richards Group is pleased to announce the addition of Dan Lyons and Susan Loynd to its Total Rewards Team. Dan will lead the Human Resources consulting practice and work with clients throughout the region.

“After listening to the needs of our clients, we decided that now is the time to develop a new range of HR consulting services to better respond to the HR challenges facing employers in our region,” said Tom Scull, Principal and Vice President of the firm. “The Richards Group is thrilled to have Dan and Susan join our Total Rewards Team, as they both bring a level of expertise and genuine client-centric focus that aligns with our organization’s values.”

Dan brings a valuable background to The Richards Group and will add Executive Recruiting and Fractional HR to TRG’s well-established Leadership Development, Human Resources, and Compensation consulting capabilities. In addition to consulting, Dan’s past experiences include Vice President of Human Resources positions for Boston-based companies and working as a Senior Human Resources Business Partner for Amazon. Dan holds a B.S. in Business Management from Texas State University, is a certified Senior Professional in Human Resources (SPHR) and is a military veteran who served in the U.S. Air Force. Dan has worked in the greater Burlington, VT community since 2019. Dan can be reached at (802) 556-1167 or by email at dlyons@therichardsgrp.com.

“I’m proud and honored to surround myself with a team at The Richards Group that has a steadfast focus on delivering excellence, and who will always do the right thing for our clients,” commented Dan Lyons. “Above all, our team puts in the effort to establish and maintain meaningful relationships and delivers work that will address the most pervasive HR challenges facing employers in Vermont and New Hampshire.”

Dan will lead a team of HR consultants that includes Susan Loynd, who was recently hired as part of this expansion, as well as Ross Gibson, former Director of the Vermont State Council of SHRM, and David Twitchell, SHRM-SCP, CCP, CBP.

Susan joined the firm as a Strategic HR Business Advisor and brings with her many years of specialized knowledge in Human Resources, which will play a vital role in helping employers navigate organizational changes and improve their work environment. Susan is originally from the Boston area, and currently resides in Fayston, Vermont. She attended the University of Vermont and the University of Kent in Canterbury, England. She began her career in Finance, Administration & Human Resources with Northern Power Systems, Inc. as a Controller and Senior Manager. After several years, she left Northern Power to work as Director of Administration & Human Resources at Washington County Mental Health Services, where she has spent the past twenty plus years, prior to joining The Richards Group. In addition to her impressive work resume, Susan serves as an instructor for several universities in Vermont and teaches for SHRM (Society for Human Resources Management) both statewide and nationally. Her courses specialize in SHRM certification prep and HR Management. Susan can be reached at (800) 222 - 6016 or by email at sloynd@therichardsgrp.com.

“I’m excited to transition from being a client to a colleague at The Richards Group” commented Susan Loynd, “and using my expertise and teaching abilities to help clients facing HR and workforce challenges.”

Tom Scull added “Dan and Susan are both well-known and highly respected contributors within our business communities. They bring an energy and level of experience that truly takes our HR Consulting services to the next level. I’m proud of the work that Ross Gibson and Dave Twitchell have done for our clients over the years. We’re excited to see this team already gaining momentum and can’t wait to witness the amazing work they will continue to do for our clients.”

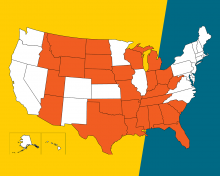

The Richards Group, headquartered in Brattleboro, Vermont, has provided local Insurance and Employee Benefits solutions to clients throughout Vermont, New Hampshire, and Massachusetts for decades. The firm currently has over 160 employees, and 11 locations, and has been named

one of the “Best Places to Work in Vermont” in each of the past 9 years by Vermont Business Magazine and the Vermont Chamber of Commerce. The Richards Group has expanded services to include Safety, Wellness and Human Resources consulting.